Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Most hostile merger approaches end with a handshake and a friendly transaction. Investors in the target ultimately want the cash premium, and if a buyer is keen enough to embark on a public fight, they are usually keen enough to offer a sweetener. But it can be fun, after a deal has been agreed, to look back at the mud-slinging that preceded it.

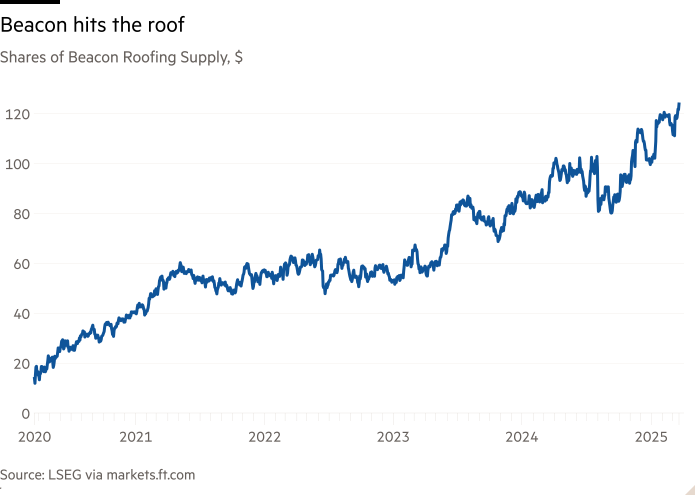

On Thursday, US billionaire Brad Jacobs finally snagged the $11bn whale he had been chasing for months. Beacon Roofing Supply said it would recommend its shareholders tender their shares at the second offer price made by Jacob’s cash shell company, QXO Incorporated.

Beacon had repeatedly insisted that Jacobs’ first offer was “opportunistically taking control of the company at a price that does not capture Beacon’s full intrinsic value”. Beacon then found two different investment banks to submit formal opinion letters that said that the $124.25 per share bid was “inadequate”.

The good news for Beacon shareholders is that its vigorous posturing did yield a higher bid. Less good: the Beacon board only wrung out 10 cents — the signed deal is for $124.35 — presumably to let the Beacon directors save a little face.

Beacon shareholders have come out fairly well, given the state of the world. The S&P 500 is down 5 per cent since early November, when QXO made its initial offer. More ominously, the shares of the seven listed companies that Beacon cites as its peers in its securities filings are down by 21 per cent on average.

Based on that deterioration, even with just the $0.10 bump, the QXO deal represents a 50 per cent premium to where Beacon theoretically would be trading today.

The question, then, is whether Jacobs, too, is getting a good deal. QXO believes it can double current Beacon’s operating profit, which would pay for the $2.5bn premium.

Jacobs has also raised $6bn by selling QXO shares to investors including presidential son-in-law Jared Kushner and Walmart’s founding Walton family, who believe that Jacobs is a singular talent. He has a record of building big companies through acquisitions, and Beacon is supposed to be the start of a new dealmaking spree. Jacobs certainly believes the hype: he posted “Slam Bam Fantastic” on LinkedIn as a response to reports of a pending Beacon agreement.

There are always losers. In this case those might include Beacon’s current management, who may now lose their jobs. But the fact that hostile merger approaches so often end in a deal — even when they are initially robustly rebuffed — should keep executives in public companies on their toes. Resistance isn’t exactly futile, but if a bidder is prepared to stump up pots of cash, there’s only so much ceiling to fight back.

Source link

Add a Comment