This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Today’s agenda: Israel strikes Gaza; short sellers make Tesla profits; UBS delays green goals; Europe debates French “nuclear umbrella”; and London’s Victorian loo-turned-cafés

Good morning. Ahead of the Federal Reserve’s rate decision tomorrow, the Financial Times polled a few dozen economists about how Donald Trump’s sweeping tariffs and rush to downsize the government would affect the US economy. Here are the key takeaways.

What’s the forecast? Almost all respondents in the survey, conducted in partnership with the University of Chicago’s Booth School of Business, said growth would slow as consumers and businesses pull back on spending. The median estimate was for the economy to expand 1.6 per cent this year, down sharply from 2.3 per cent when the economists were surveyed in December. They also expect Trump’s policies to fuel higher inflation, predicting the personal consumption expenditures price index — a gauge closely watched by the Fed — will rise at an annual rate of 2.8 per cent by year-end, from a December forecast of 2.5 per cent.

Why is it happening? It boils down to the uncertainty and unpredictability surrounding the president’s policies. A Johns Hopkins expert said he had seen “nothing of the sort” in his 50 years of forecasting, referring to the simultaneous tariffs, tax cuts and changes to various government departments in the US. The uncertainty is “so high now that it seems likely to reduce investment”, one economist at Harvard said, adding that “how much will depend on how long it persists”. But it was not clear which policy actions would stick, given the administration’s reversals and legal challenges, another expert said.

Here’s more from the survey, and we have more on the global impact of Trump’s policies below.

-

Fleeing academics: Science institutions in Europe and beyond are racing to hire researchers from the US looking to escape the Trump administration’s crackdown on research agencies.

-

Nigerian rally: Foreign investors are flocking to the African country’s markets as they look to dodge the effects of a US trade war with larger developing economies.

Here’s what else we’re keeping tabs on today:

-

Trump-Putin call: Ahead of talks with his US counterpart today, Russia’s president allowed a group of western investors to offload Russian securities left in limbo by Moscow’s invasion of Ukraine.

-

UK-US trade: Britain’s trade secretary, Jonathan Reynolds, will hold talks in Washington in a bid to win an exemption from Washington’s tariffs.

-

German debt brake: Incoming chancellor Friedrich Merz has expressed “confidence” about today’s make-or-break vote in parliament over his plans to unlock up to €1tn.

-

Chips: Nvidia chief Jensen Huang will address the company’s AI conference in San Jose California, while Lip-Bu Tan begins his term as Intel’s CEO.

Join FT experts next Thursday for a subscriber-only webinar, as they discuss Ukraine’s future with Russia’s full-scale invasion entering its fourth year. Register for free.

Five more top stories

1. Israel has launched “extensive strikes” in Gaza, saying it was hitting Hamas targets because the militant group had rejected US proposals and repeatedly refused to release hostages. Health authorities in the enclave said more than 100 people were killed in the strikes, which appear to be the most intense assault on the territory since a ceasefire took effect.

2. Hedge fund short sellers have made $16.2bn betting against Tesla’s shares as the value of Elon Musk’s electric car company has halved over the past three months. JPMorgan last week lowered its end-of-year target price for Tesla from $135 to $120, while one hedge fund manager said: “[Musk] is on the wrong side of his buyership. It’s not people with cowboy boots who buy Teslas.”

3. Exclusive: UBS has pushed back a target to cut its greenhouse emissions to net zero by a decade, blaming its acquisition of crosstown rival Credit Suisse for the delay. The Swiss bank revised its target to decarbonise its own operations to 2035 from 2025, according to a disclosure in its latest sustainability report published yesterday.

4. Exclusive: Walgreens Boots Alliance’s executive chair Stefano Pessina will almost double his stake in the US pharmacy group to about 30 per cent as part of its takeover by private equity group Sycamore, according to people familiar with the matter. Read the full story.

5. Exclusive: Indian billionaire Sunil Bharti Mittal has indicated that he is considering increasing his holding in BT after taking a 24.5 per cent stake in the UK telecoms company last year, according to people familiar with the matter. Kieran Smith has more details from London.

News in-depth

Emmanuel Macron has invited fellow European leaders to discuss whether — and how — his country’s nuclear arsenal could be used as a deterrent against future Russian aggression. But the French president’s allies may not like the limitations he may choose to keep on the force de frappe.

We’re also reading . . .

-

Greenpeace vs Big Oil: Civil rights experts say the case being heard against the activist group has consequences on free speech that are “far bigger than the environment”.

-

Canary Wharf: The finances of the London Docklands district have stabilised, but it must transform quickly, writes John Gapper.

-

AI ‘brain’: Microsoft has joined forces with a Swiss start-up to deploy a new model that can learn from real-world experiences by simulating mammal brains’ reasoning powers.

-

Consumer psychology: Sarah O’Connor’s gratitude at finally finding a printer that works tells us something about capitalism, she writes.

Chart of the day

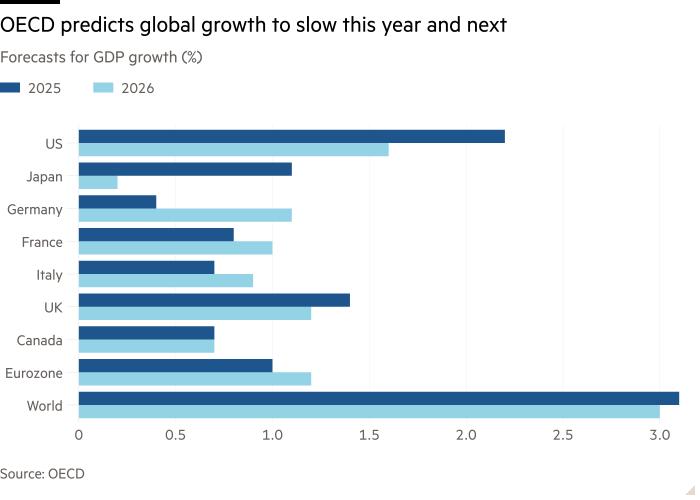

Trump’s trade war is taking a “significant toll” on the global economy, the OECD warned in its interim outlook. The Paris-based organisation cut growth forecasts for a dozen G20 countries and said inflation will be stickier than previously expected.

Take a break from the news . . .

Across London, century-old underground public toilets are being converted into bars, cafés and shops. Would you eat your avocado toast in an old Victorian loo?

Source link

Add a Comment