This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Today’s agenda: Fed cuts US outlook; EU probes BYD plant; Israel’s “forever war”; Turkey’s authoritarian slide; and Europe’s meme stock moment

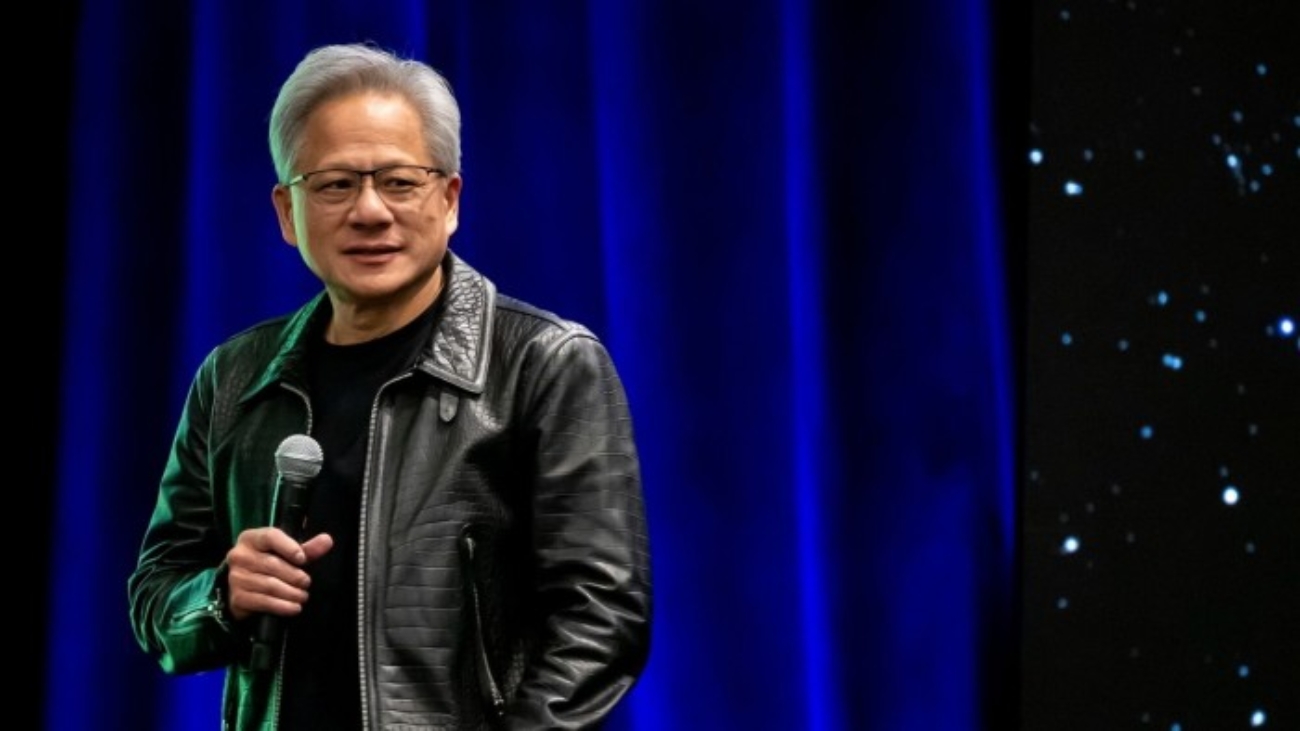

Good morning. We start with a wide-ranging interview with Jensen Huang, who spoke to the Financial Times as Nvidia unveiled its latest artificial intelligence chips at the company’s annual developers’ conference.

What are Nvidia’s plans? The company will spend hundreds of billions of dollars on chips and other electronics manufactured in the US over the next four years, the chief executive said, as it tilts its supply chain back from Asia. Huang added that Nvidia was now able to manufacture its latest systems in the US through suppliers such as Taiwan Semiconductor Manufacturing Company and Foxconn.

What’s behind the move? America’s biggest technology companies have become overwhelmingly reliant on TSMC’s cutting-edge chipmaking facilities in Taiwan. That dependency has been clouded by the growing threat of aggression by China — which claims Taiwan as part of its territory — as well as Donald Trump’s threats of tariffs on Taiwanese semiconductors. “The most important thing is to be prepared,” said Huang.

We have more from Nvidia’s CEO, including his thoughts on Intel and Chinese rival Huawei, and more on AI below:

Here’s what else we’re keeping tabs on today:

-

Economic data: The European Central Bank publishes its economic bulletin, the UK has labour market figures and Germany has its producer price index for February.

-

UK rate decision: The Bank of England is expected to hold interest rates steady. For more on monetary policy, sign up for Chris Giles’ Central Banks newsletter if you’re a premium subscriber, or upgrade your subscription here.

-

EU summit: Leaders from around the bloc will discuss Ukraine and regional defence plans when they meet in Brussels.

-

Results: Accenture, CK Hutchison, FedEx, Lloyd’s of London, Micron and Nike report.

Five more top stories

1. The Federal Reserve slashed its US growth forecast and lifted its inflation outlook yesterday, while keeping its main interest rate on hold. Fed chair Jay Powell told reporters that President Donald Trump’s tariffs had affected “a good part” of the central bank’s outlook.

2. Exclusive: The EU is investigating whether China provided unfair subsidies for a BYD electric car plant in Hungary, in a highly sensitive move to target the deepening economic ties between Beijing and Viktor Orbán. Should Brussels find that the Chinese company benefited from unfair state aid, these are the actions it could take.

3. Trump proposed that the US take over Ukraine’s nuclear power plants in a phone call with Volodymyr Zelenskyy yesterday. The Ukrainian president also agreed to back an American proposal to halt strikes on Russian energy infrastructure. Here’s more from their call.

4. Elon Musk’s X has raised about $1bn in a new equity funding round that values the social media company at $44bn, bringing its valuation back in line with the price the billionaire paid in 2022. Musk, X’s majority shareholder, was among those who purchased the shares. Here were some of the other investors.

5. Exclusive: China is boosting state support for domestic minerals exploration as policymakers pursue the country’s goal of self-sufficiency amid intensifying competition with the US. At least half of China’s 34 provincial-level governments announced more subsidies or expanded access for mineral exploration in the past year, an FT analysis shows.

News in-depth

With Israel renewing its offensive against Hamas this week, thousands of reservists in the Israel Defense Forces now face the prospect of an immediate return to war. Yet it is unclear how much more they can take. With no end in sight, experts and reservists have begun to warn of growing attrition on the fighting force, with jobs, families and lives put on hold.

We’re also reading . . .

-

Turkish politics: The arrest of Recep Tayyip Erdoğan’s main rival marks a dangerous turning point in the country’s authoritarian slide, say politicians and investors.

-

EU ‘strategic autonomy’: Trump has pushed the bloc from “costs too much” to “whatever it takes”, as it cuts dependence on US systems such as Starlink, writes Alan Beattie.

-

UK Spring Statement: The chancellor’s strategy next week is to steer a steady ship in choppy waters, writes Chris Giles. That’s fine — for now.

-

Bezos and Trump: Amazon’s founder has executed a sharp public reversal in his relationship with the president that has surprised even longtime associates.

Chart of the day

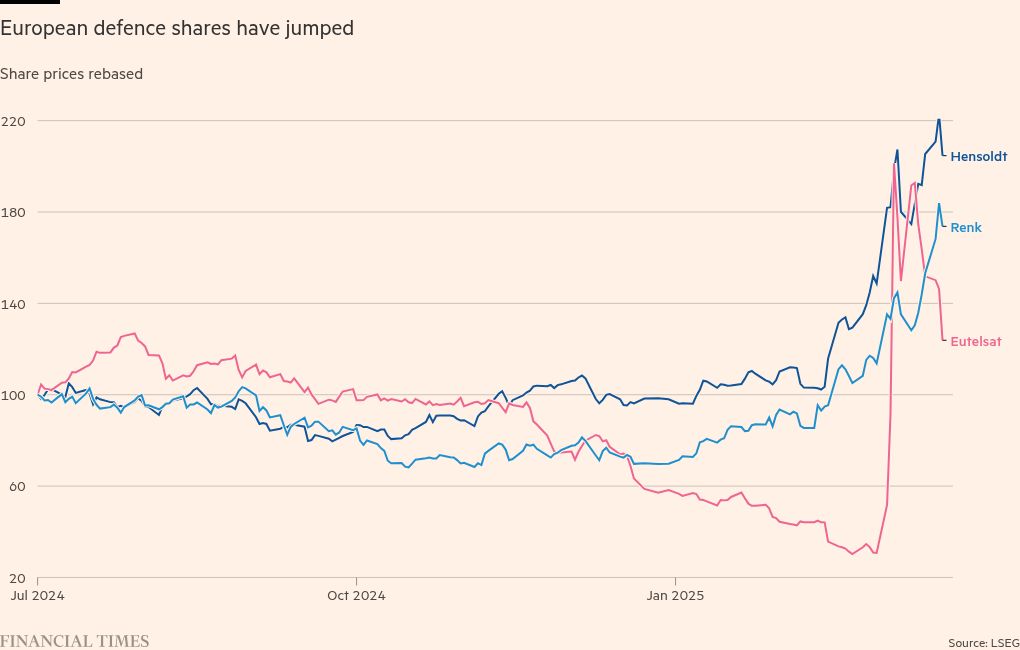

In an echo of the “meme stock” craze of 2021, a handful of European stocks have become a battleground for retail traders taking on hedge fund short sellers. Small-scale traders — some co-ordinating their efforts on Reddit — have turbocharged gains in these companies, which have far outstripped a broader rally led by the defence sector.

Take a break from the news . . .

Securing a restaurant reservation has never been harder. Thankfully, our food columnist Ajesh Patalay has insider tips for landing a table.

Source link

Add a Comment