China is a key market for any automaker, and Porsche is finding ways to stay relevant

Mainland China is the world’s largest auto market, nearly as large as the US and European markets combined. Global automakers have enjoyed decades of prosperity thanks to a slow-moving home auto industry, but that dominance appears to be coming to an end. Despite building cars that some consider peerless, Porsche isn’t immune to feeling the pain.

Electric Porsche Macan TurboPorsche

Porsche sales in China fell significantly for the second consecutive year

In 2023, Porsche had bad news regarding sales in China: deliveries dropped 15 percent year over year, and it was the only market where the automaker saw any downturn at all. Unfortunately, the trend carried into the next year. Porsche saw an even more substantial downturn of 28 percent, delivering just under 57,000 cars in the entire country and establishing a record in decline for the brand. Detailing the concerns and outlook in a press release, it sounds like Porsche isn’t anticipating things getting any easier, either. They’re “expecting market conditions to remain very challenging and for competition in China to intensify.” Further geopolitical uncertainties, the looming cloud of a trade war, and a growing domestic auto manufacturing framework are all to blame, if you believe Porsche.

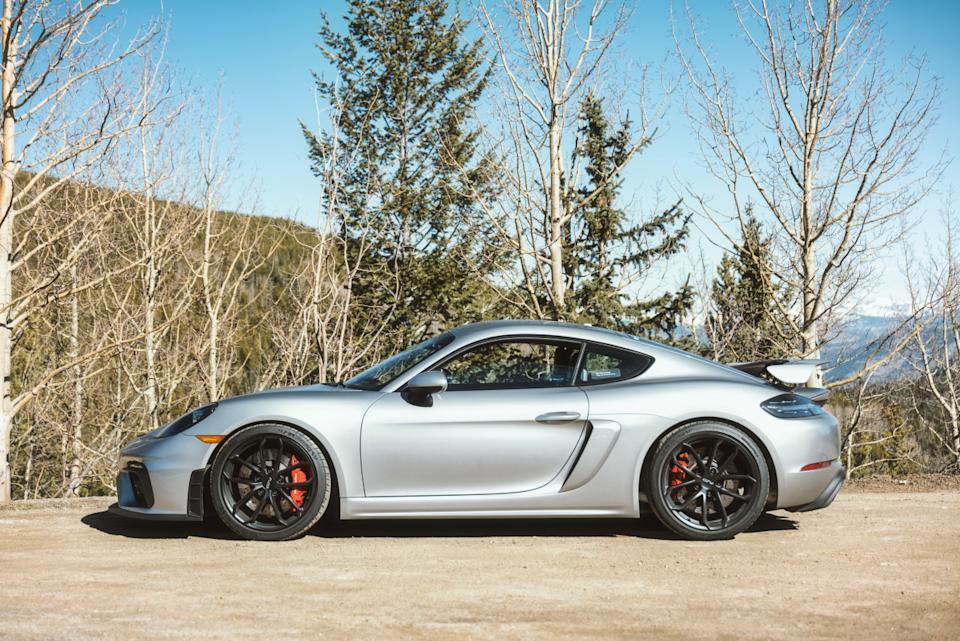

718 Porsche GT4Evan Lewis (@evanlewis.expedition)

Porsche’s strategy going forward

Giving up isn’t really in the spirit of the motorsport-infused Porsche brand. “China remains central to Porsche’s global strategy,” says Oliver Blume, the company’s CEO in a brief Q&A. He says the brand is sticking to a “value over volume” strategy, recognizing that “Chinese customers have highly personalized needs and a strong preference for the digital ecosystem.” That loosely translates to an emphasis on customizability and technology. “At the same time,” he continues, “we trust the core values of our brand.” Blume thinks that the Porsche vehicles speak for themselves via their competence and personalization. In a separate press release, the brand vows to “balance demand and sales,” which likely indicates a focus on manufacturing at lower levels in order to keep demand and costs in line with expectations.

Xiaomi SU7Xiaomi

Interestingly, Porsche’s verbiage overall is very similar to last year’s. When considering the 2024 marketplace, Detlev von Platen, Member of the Executive Board for Sales and Marketing, expected “market conditions in China to remain challenging.” Perhaps the brand did not pivot enough. More likely, the competition is simply getting much, much more convincing to Chinese buyers, even those at higher income levels. After all, when options like the Xiaomi SU7—arguably, “the Taycan at home”—start outperforming while undercutting on price, it’s clear some shoppers might not even consider a Porsche in China.

Final thoughts

In summary, Porsche appears to be considering an even more boutique approach than it already offers. The brand is already heavily reliant on its performance and quality legacies, and those two things are the only thing separating it from more accessible Chinese rivals. Whether or not it’s enough to seriously sway them is another story.

Source link

Add a Comment